[ad_1]

Last time we talked about the UBA Freedom account, how to open an account, and also how to upgrade it.

In that article, I explained why the freedom account is limited and I also said ATM cards are not allowed for freedom accounts.

People tend to mix the UBA freedom account with the UBA domiciliary account. This is because the two are domiciliary accounts. But they are two different things, although both account support foreign currencies one has some limitations while the other comes with a premium service.

Before we move forward we would want to know what the UBA Dom account is all about.

What is a UBA Dom account?

The “Dom” which is after the UBA is an abbreviation for domiciliary. The UBA Dom account is an account that can receive foreign currencies.

The UBA domiciliary account supports currencies like USD (United State Dollars) Euros and some other foreign currencies.

What is the difference between the UBA domiciliary account and the UBA Freedom account?

| UBA Dom account | UBA Freedom account |

| You can transfer money | You can’t transfer |

| You can get an ATM card | You can’t get a card |

| $20 annual maintenance fee | No maintenance fee |

| Minimum of $100 account opening | Free account opening |

| Premium service | An upgrade will be needed as soon as you reach the $2000 threshold |

UBA domiciliary account requirements

- A minimum of $100 for account opening

- A passport photograph

- BVN (Bank Verification Number) if you are in Nigeria

- Utility bills ( Electricity, water, bank statement of account, etc) not more than three months old

- Government-approved ID card

How to open A UBA account

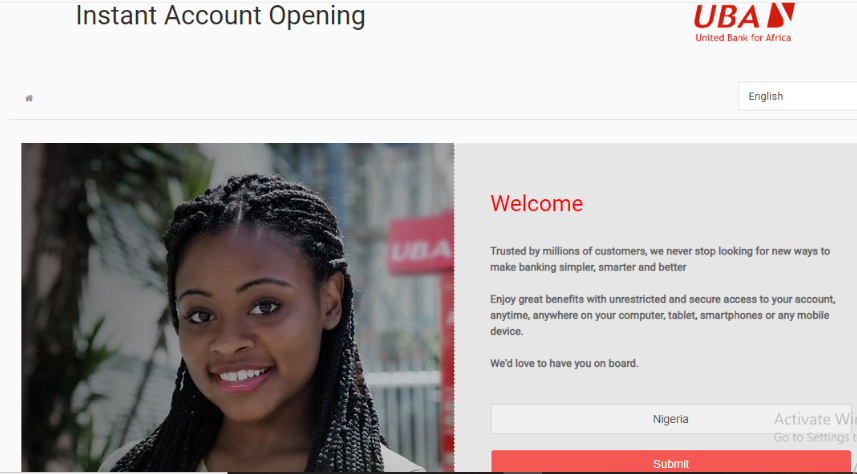

- You can register online

- Or go to any UBA bank close to you

* Register online

To register online you will need a data connection with a device to access the internet (Preferably a computer). Follow the steps below to register online.

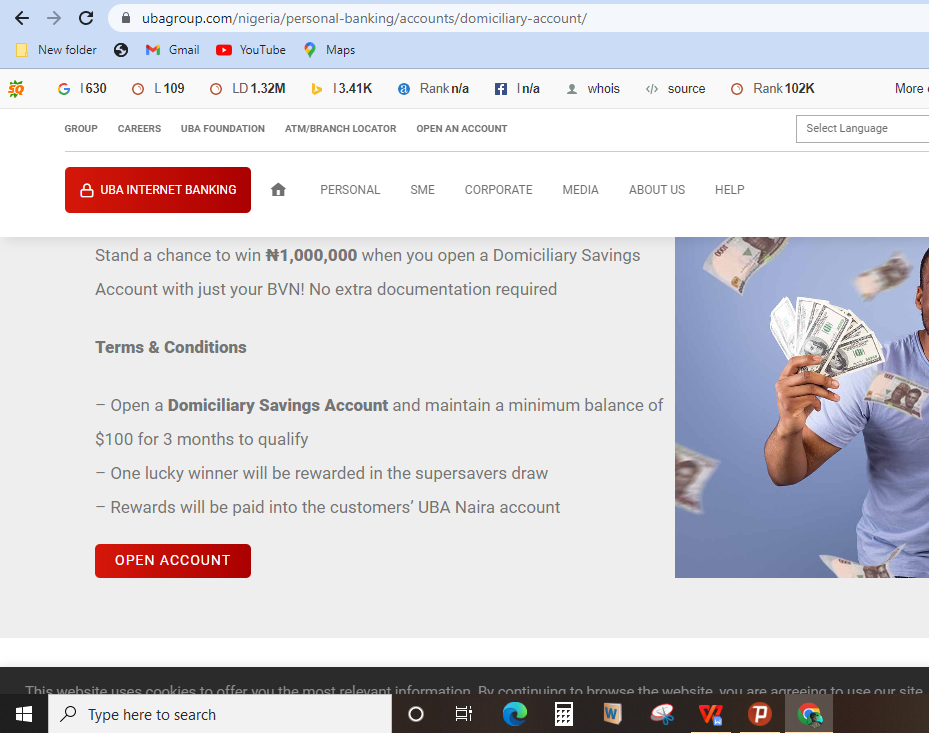

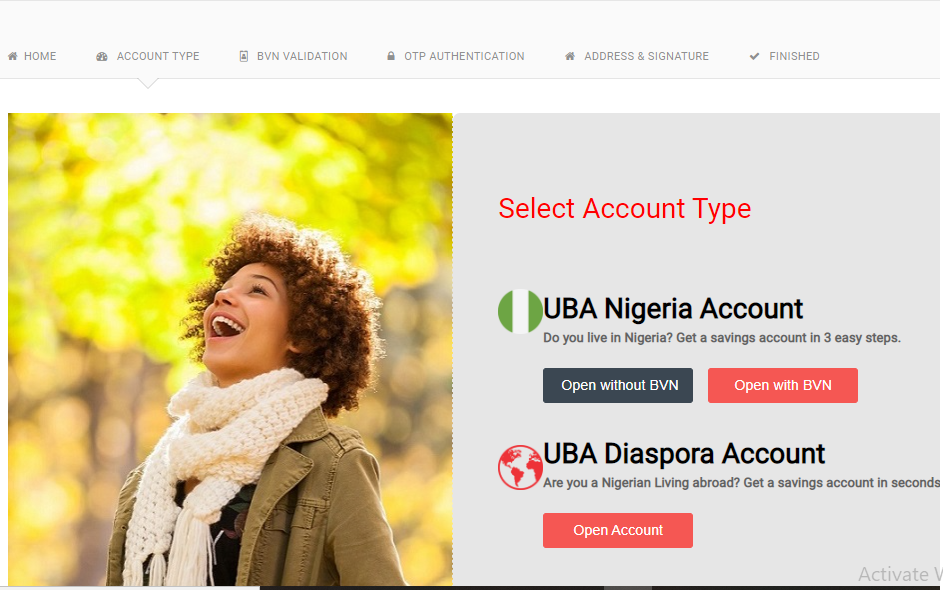

1. Log on to the UBA official website

2. Scroll down to open an account, click on open account

3. Select your country where you want to open the account

4. Under (Select account type) click on open with BVN. Mind you if you don’t have a BVN you can’t go for this premium account.

You should go for the Freedom account as you might not provide the information now but you will surely do when you are about to get your money.

For those who are not in Nigeria or didn’t choose Nigeria as their region of account opening, you might not need to input your BVN.

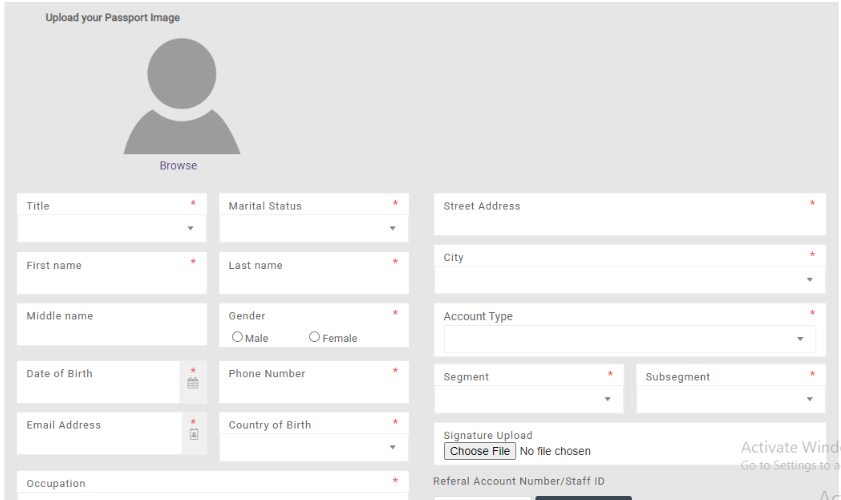

5. After that, you will need to input your credentials like Name, place of birth, gender, signature, and so on.

6. Accept their terms and conditions, then click on the submit button.

Note: Your attention might be needed in the bank for other official purposes.

* Going to any UBA bank close to you

You will need to visit any UBA bank close to you to carry out this process. This process might take your time especially if you have to queue before it gets to your turn. But it is still the best option because you will be able to ask more questions about account registration and more.

Follow the process below.

1. If you’ve gotten the requirements as stated above, go to any UBA bank close to you and tell any of the customer care representatives that you want to open a Dom account. Make sure it’s for the premium service (UBA domiciliary account) and not the Freedom account.

2. You will be given two forms, one for you and one for your referees. You can fill out your form in the bank. In the form, you will need to write down your details like (BVN, your name, location, state of origin) and so on.

Also, you will need to give that of the referee to the referees. The (Reference form) is two in one. This means one section for referee A and the other Section for referee B. Your referees are supposed to engage on the dash and open box areas and not touch the area of (Official use). The (Official use) area will be done by the UBA bank and the referee’s bank.

If your referees are all using UBA bank then verification will be quick but if they are not using UBA bank, UBA will need to go to the bank they are using to confirm the referee’s information, especially the signature.

3. Submit all the requirements (Government approved ID card, utility bill, passport photography, a minimum of $100)

4. Upon the success of account opening, your user ID and password will be sent to you in a form of a text message. With this, you can check transaction details and also check your balance

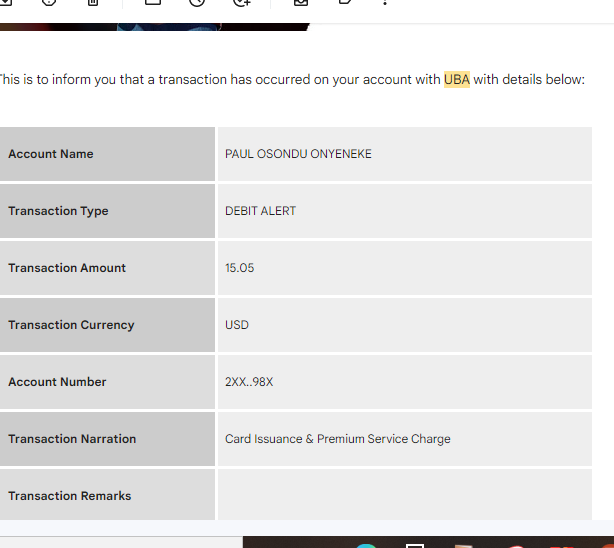

Note: If you ticked the (get ATM card) box on your form, $15 will be deducted instantly on activation. The $15 is for the ATM card and premium service charge.

What is the UBA domiciliary ATM card?

The UBA domiciliary ATM card is a card issued by UBA customers in other to carry out payments, POS purchases, and web payments. The UBA dollar card is equipped with NFC, with this technology you can make payment by just touching your card on the machine.

I opt-in for the UBA Dom Mastercard, it also worked flawlessly when you connect it with your Paypal, unlike the Naira Mastercard which can’t be used with Paypal.

What can you do with the UBA domiciliary ATM card?

The UBA domiciliary ATM card is different from regular ATM cards, it has three technologies of payment, NFC, mag stripes, and chip.

Here are some things you can do with your UBA domiciliary ATM card:

1. Easy payment method, as we said earlier the UBA domiciliary ATM card comes with three technologies chip, magstripe, and NFC. You don’t need to insert your card into the machine, once you touch your card on the machine then you enter your password payment will be made.

2. Making payments on the web. The UBA dollar Mastercard fully supports Paypal. Once you fill in your card details correctly, your account will be linked to Paypal. Also, the regular $1 debit and refund which Paypal is doing. This is to verify if the card can make and receive funds, it won’t be tested this time around. You can also make payments online by just filling in your card details.

3. The dollar card is widely supported, no need to worry when traveling.

How to activate the UBA domiciliary ATM card

Activating the UBA domiciliary ATM card is quite simple. All you need to do is to find a nearby ATM, insert your card, and change your PIN that’s all.

The UBA domiciliary ATM card transaction limits

As we all know there’s always a limit to anything in this world. The UBA domiciliary transaction is limited to:

| Maximum withdrawal for a day | $2000 |

| POS Spend limit within a day | $10000 |

| WEB spend limit within a day | $5000 |

UBA domiciliary account charges

Unlike the UBA freedom account where you have no fees, the reverse is the case here. As my friend says “Premium service premium payments”.

- Annual maintenance is $20

- Card replacement $10

Pros of the UBA Dom account (Premium service)

1. You can make use of ATM cards: unlike the Freedom account, the UBA domiciliary account gives you access to the use of ATM cards.

2. You can transfer with it. The freedom account doesn’t accept transfers, but with this premium service, you can make transfers easily

3. No $2000 limit: last time when we discussed the UBA freedom account we said it has a limit of $2000 which needs to be upgraded upon the Threshold reach.

4. You can make web transactions. Before moving from the freedom account to premium, I can’t do online transactions. But with the UBA Dom account, you can now make an online transaction.

Conclusion

The UBA domiciliary account is an upgrade of the UBA Freedom account. You can get the account directly without moving from Freedom to the UBA Dom account As I did. The UBA domiciliary account gives room for online transactions, and ATM withdrawal (Only with ATMs using foreign currencies).

A minimum of $100 will be needed to open the account, also $15 will be charged for account upgrade and ATM card issuance.

I will love to hear from you in the comment section, which are you currently using? Is it the UBA Freedom account or the UBA domiciliary account (premium service)?

Related

[ad_2]

Source link