[ad_1]

A new report by consulting firm McKinsey & Co. highlights “substantial” challenges for cities and commercial real estate players due to the long-term impacts from hybrid work.

The researchers studied nine “superstar cities” that feature a significant portion of the world’s urban gross domestic product (GDP) and growth: Beijing, Houston, London, New York City, Paris, Munich, San Francisco, Shanghai, and Tokyo.

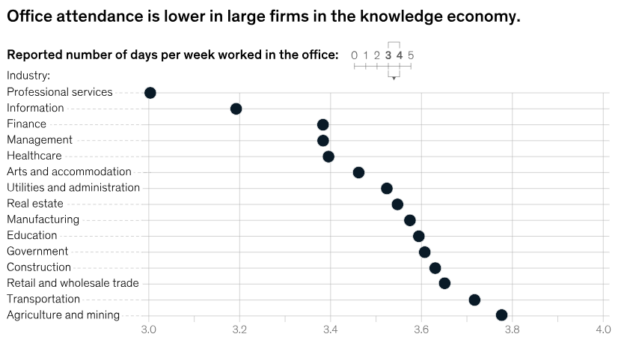

Office attendance is down by about 30% compared to pre-pandemic levels on average, the report found. Employees in professional services, information, and finance industries typically commute to the office about three days per week.

The researchers concluded that hybrid work will likely remain consistent as office attendance has been steady since mid-2022. They said attendance could change depending on labor market dynamics or new findings related to a negative or positive relationship between hybrid work and productivity.

In a “moderate scenario” modeled for 2030, demand for office space is 13% lower than 2019 for the median city in McKinsey’s study. That number rises to 38% for the most heavily affected city in a “severe scenario.”

In a moderate scenario, total value of office space could decline by 26%; in a severe scenario, it could decline by 42%, the report said.

The Federal Reserve said it has concerns about the impact of declining office demand on the commercial real estate sector. Lending for office space is a “core activity” for U.S. banks, particularly community or regional banks.

A survey by S&P Global showed that most top office lenders upped their exposure last year, but nine out of 17 banks with office loans of at least $400 million reduced their quarter-over-quarter exposure in the fourth quarter due to weakened demand and macroeconomic conditions.

In order to address the growing glut in office space in major cities, urban stakeholders should consider a mixed-use model for using available resources, McKinsey researchers wrote. From the report:

- City planners should consider weaving multi-family housing within commercial office-dense districts. They suggested that multi-family housing is more environmentally friendly in terms of carbon efficiency, and constructing new housing could help alleviate the persistent housing shortage.

- Developers should construct hybrid buildings, which can easily adapt to different uses based on changing customer preferences. However, they said this would be challenging, as it will require rezoning, construction, lease renegotiations, and overcoming other obstacles.

- The researchers recommend that developers and designers should create adaptable spaces at the floor level. These spaces should have the capability to transition from a work area to a space for events and activities.

Seattle-area office vacancy rates have more than doubled from pre-pandemic levels. Vacancy rates rose to 12.2% in the second quarter, up from 11.2% in the first quarter and 2019’s low mark of 5.79%, according to a report from commercial real estate firm Kidder Mathews. That’s the sixth consecutive quarterly increase in regional vacancy.

Seattle Mayor Bruce Harrell has made returning foot traffic to downtown a major agenda item. His office also recently held a competition challenging city planners to explore ways of converting existing office space into new residential and commercial uses. The winning team Hybrid Architecture created a plan to convert the Mutual Life Building in downtown Seattle into a co-living space, complete with affordable units and common spaces.

[ad_2]

Source link