[ad_1]

The PC market has been experiencing an economic hangover after the COVID-19 pandemic. Sales are down for all involved, and both Intel and AMD have been especially hard hit. Gamers and creators have held off on upgrading their PCs, and companies have had second thoughts on expanding due to various economic concerns. New reports from industry analysts shed some light on how the recent downturn has affected the CPU market. Intel has continued to take market share from AMD in desktop and notebook, and AMD has been eating away at more of Intel’s data center pie.

The reports highlight the struggles both companies have faced over the past few quarters, which have been historically brutal. Intel posted its biggest quarterly loss in history for Q1, and it’s also been reported that AMD has struggled to offload its new Zen 4 CPUs, as evidenced by recent price cuts despite the CPUs being relative newborns. However, AMD has some built-in resilience with its embedded and data center products, which have helped it weather the recent turbulence.

Despite Intel’s difficulties, it remains the dominant force in client and data centers, owning the lion’s share of the markets where it competes with AMD. All the cries of “RIP Intel” are severely misguided due to its size and market position. Semiconductor industry analyst Sravan Kundojjala (via TechPowerUp) notes that both Intel and AMD had sizable YoY losses ending in Q1 but that Intel was able to claw back some client market share from AMD regardless. As it currently stands, Intel still controls almost 80% of the market for laptops and desktops.

On the data center, the fortunes are reversed, with AMD reportedly taking 10% of the market from Intel over the past year, according to Counterpoint research. However, Intel still controls over 70% of the data center market, with AMD now holding onto almost 20%. AMD famously beat Intel to the market with its 4th generation Epyc “Genoa” CPUs, launched in November of 2022. Intel had repeatedly delayed its 4th gen Scalable Sapphire Rapids CPUs but finally announced them in January 2023.

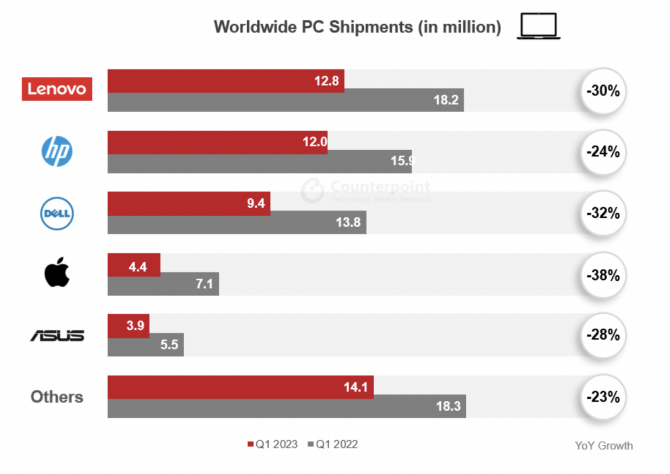

It’s been a tough year for the entire PC industry, which includes Apple.

Credit: Counterpoint Research

The PC market is expected to rebound in the second half of 2023 as existing inventory dries up after several quarters of supply outweighing demand. Companies have also been holding back inventory as well to safeguard their pricing. That’s expected to ease up as the market begins to show renewed vigor, which is anticipated to extend into 2024 as the upgrade cycle starts anew. Analysts believe that by next year all the hardware purchased in 2020 when the pandemic started will need to be replaced, and a new version of Windows is also expected.

[ad_2]

Source link