[ad_1]

For 2022, Intel earned $63.1 billion in total, a 20% decline from its 2021 earnings. Its Q4 revenue was $14 billion, a precipitous 32% drop from the same quarter last year. One analyst notes this is the largest year-over-year decline in the company’s history. It posted a net loss of $664 million for the quarter, which almost matches its worst quarterly loss in history: In 2017, it reported a loss of $687 million in the fourth quarter.

Though Intel ended 2022 with $8 billion in profit, last year it made $19.1 billion. That’s a remarkable 60% reduction, which is why the word “collapse” is being thrown around. Its gross margin for Q4 of 39.2% is the lowest in decades as well. Intel used to get 60% margins not that long ago.

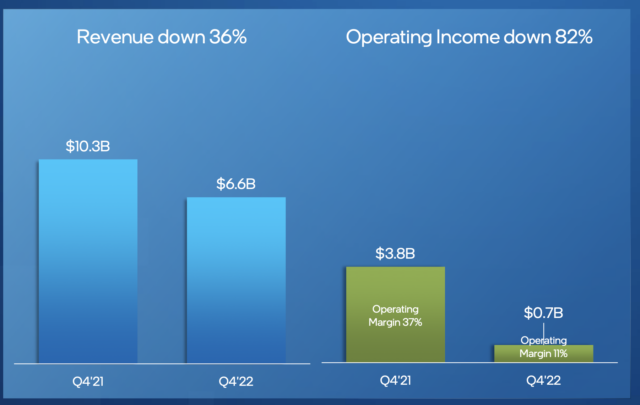

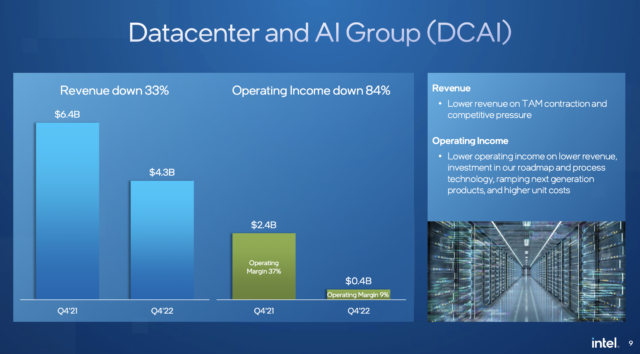

As far as where the hits came from, it’s in both data center and client computing. It earned $6.6 billion on the client side, which is down 36% from last year’s Q4. Total revenue for client computing in 2022 dropped 23% compared with 2021. Its Data Center and AI (DCAI) group’s revenue fell 33% YoY, and 15% for the year as a whole. The only bright spots were gains in Mobileye, Intel Foundry Services, and its graphics division. All three divisions posted increases, with its foundry services posting a surprising 30% improvement for the quarter.

Despite the grim report, Intel says it’s still on target to achieve its long-term goals. It notes it’s still pursuing its “five nodes in four years” strategy laid out by CEO Gelsinger upon his arrival in 2021. This will theoretically allow it to achieve industry leadership in both transistor performance and efficiency leadership by 2025. To that end, Gelsinger says it’s looking to begin its ramp for Meteor Lake in the second half of 2023. If that occurs, we’ll be surprised as it’s been rumored to be delayed. Instead, we may see a Raptor Lake refresh.

“We are at or ahead of our goal of five nodes in four years,” said Gelsinger in the earnings report. “Intel 7 is now in high-volume manufacturing for both client and server. On Intel 4, we are ready today for manufacturing and we look forward to the MTL (Meteor Lake) ramp in the second half of the year,” he said.

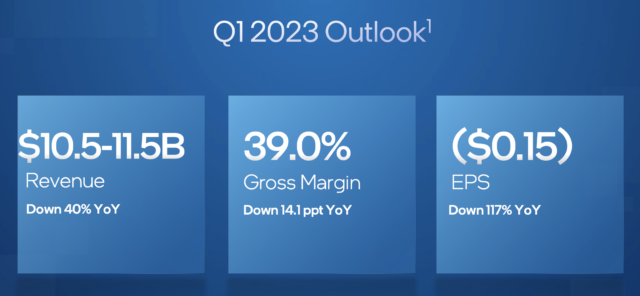

Unfortunately for Intel, it doesn’t anticipate a quick rebound from its financial nadir. Its CEO predicted continuing “macro weakness” through the first half of 2023. However, he noted there’s a possibility of an uptick later this year. Given the uncertain economic conditions though, Intel is only providing guidance for Q1 of 2023 and nothing beyond that. That guidance is even more brutal than this report: It predicts YoY revenue will be down 40%, with gross margins hitting 39%.

Intel’s earnings report follows news this week that it has canceled a planned $700 million R&D facility in Oregon. It was also announced this week that it was laying off 544 employees in California as it begins to tighten its belt. It’s stated it plans on reducing expenses by $3 billion in 2023, with that number increasing to $10 billion by 2025.

Now Read:

[ad_2]

Source link