[ad_1]

TSMC announced it was beginning its initial 3nm wafer production run at the end of 2022. Now that it’s April, the company is already running into issues, which isn’t a huge surprise as it’s common when working with an entirely new advanced node. However, it might cause a problem for what is likely its only customer: Apple. The Cupertino company has reportedly procured the entirety of TSMC’s first batch of 3nm wafers, but its CEO is now saying its customers’ demands, plural, are already exceeding its capacity.

News of TSMC’s troubles comes via the horse’s mouth, company CEO and chairman C.C. Wei. In a recent conference call with analysts, according to EETimes, Wei said, “As our customers’ demand for N3 exceeds our ability to supply, we expect N3 to be fully utilized in 2023, supported by both HPC and smartphone applications.” Even though he says there are customers, plural, it sounds like he’s just talking about Apple here. The company is widely known to be tapping the N3 node for its upcoming iPhone 15 Pro and Pro Max and using it for its forthcoming M3 silicon. EETimes said analysts it surveyed described TSMC as facing tool and yield issues as it ramps N3 production.

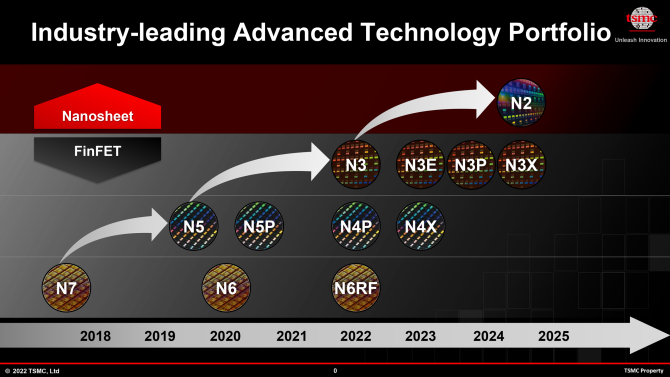

TSMC’s roadmap shows it delving N3E and N4X this year.

Credit: TSMC

The report says Apple only has to pay TSMC for fully-functional N3 dies. However, yield issues have resulted in Apple not having to pay for every wafer produced so far. The report said the company expects yields to improve as the company ramps production throughout 2023. By the fourth quarter of the N3 ramp, yields will likely be approximately 70%. Apple is expected to reach normal wafer pricing for N3 in the first half of 2024.

TSMC is going to have a busy third quarter. The report states it’ll continue production of Apple’s A17 Bionic chip and all-new M3 processors for the Mac. Additionally, it’ll be producing the GPU tile for Intel’s Meteor Lake CPUs on its 5nm node, which confirms previous reporting that Intel would skip N3 for it. It’ll also continue producing AMD’s Genoa and Nvidia’s Grace and H100 chips on N4 and N5.

Despite its troubles, TSMC is still seen as the clear leader in the race for 3nm supremacy, according to analysts. As you might recall, Samsung beat TSMC to the punch by announcing 3nm production had begun in July of 2022. Despite its six-month head start on TSMC, analysts report that Samsung has yet to demonstrate “a stable, leading-edge process technology.” As far as Intel goes, the report states it’s still years away from 3nm, which isn’t breaking news. It’s a race that will define the technology landscape for years to come.

It’ll also be highly profitable. TSMC has previously stated it expects to earn over $1.5 trillion from N3 over its lifecycle, which it expects to last for many years.

[ad_2]

Source link