[ad_1]

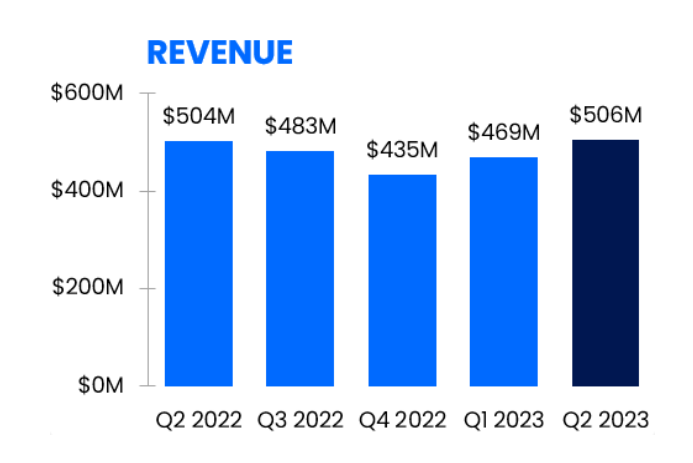

Zillow Group revenue rose slightly to $506 million in the second quarter, well ahead of its prior guidance of $451 million to $479 million for the three months ended June 30, the company reported Wednesday afternoon.

But despite exceeding Wall Street’s expectations and outperforming the overall market, the Seattle-based real estate services and media company continued to feel the effects of higher mortgage rates and a challenging housing market.

- Residential revenue, including Premier Agent advertising services for real estate agents, declined by 3% from a year ago to $380 million for the quarter.

- Mortgages revenue fell 17% to $24 million, which the company attributed to higher mortgage rates impacting demand and its mortgage marketplace.

- Traffic to Zillow Group’s websites and apps slipped 3% to 226 million average monthly unique visitors, with 2.7 billion visits, down 8% from a year ago.

One bright spot: rental revenues rose 28% to $91 million for the quarter, which the company attributed to strong traffic and growth in multifamily properties.

Looking ahead, Zillow Group said in its second-quarter letter to shareholders that its current revenue outlook for the third quarter is $458 million to $486 million. That’s below the average analyst estimate of $488.1 million for the upcoming quarter. Shares fell 2% in after-hours trading, after the earnings report.

Lead by serial entrepreneur Rich Barton as CEO, Zillow Group has been remaking itself since exiting the “iBuyer” home-flipping business in 2021 to focus on core businesses including real estate listings, home loans, and real estate agent advertising. Its brands include Zillow.com, Trulia, StreetEasy and HotPads.

“I’m pleased with our steady progress on improving and integrating our customer and partner experiences, especially in touring, financing, and renting,” Barton said in a statement. “The housing super app is coming into focus, opening up significant transaction TAM [Total Addressable Market] for the company and our shareholders.”

On the bottom line for the second quarter, Zillow Group posted a net loss of $35 million, vs. a profit of $8 million in the same quarter a year ago, as calculated using Generally Accepted Accounting Principles (GAAP).

However, on a non-GAAP basis, adjusted for share-based compensation and other factors, earnings per share were 42 cents, significantly ahead of Wall Street expectations of 18 cents per share, as reported by Yahoo Finance.

Overall revenue of $506 million compared with expectations of $471.6 million.

[ad_2]

Source link